Knowing the barriers can help financial advisors better clarify the benefits of this valuable service.

.

An opportunity…

.

Many people have a need for a financial plan and are interested in the benefits but stop short of reaching out for information because of their preconceived notions about the financial industry. They want clarity on costs and what the plan entails. There is a great opportunity to introduce investors to your firm with a financial plan offer. It could also be a great way to provide leads to junior advisors, or you could utilize a paraplanner to help facilitate the plan creation for your office.

.

Insights into reasons people do or don’t get a financial plan…

.

We ran a survey to test out some theories on what may be some barriers to people getting a financial plan. The responses were very insightful and could be used in formulating campaigns to get financial planning leads.

The survey was based on full-time employed adults living in the United States. There were 162 responses, 60% were from women, 40% from men, and 59% were in the 30-44 age range.

Have you ever had a financial plan prepared for you by a financial advisor?

.

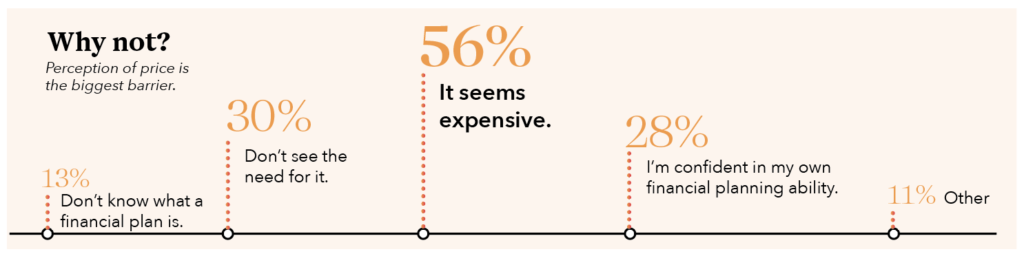

Of the people who said NO…

.

Why not?

Perception of price is the biggest barrier.

.

What price would you be willing to pay?

.

.

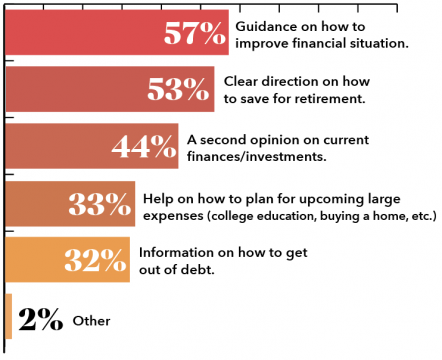

Which, if any, of these benefits of a financial plan would interest you? Select all that apply.

.

Of the people who said YES…

75% received a financial plan within the last 5 years.

67% plan on getting an updated financial plan at some point.

.

How much did you pay for your financial plan?